Below you’ll find an alphabetical list of important terms for options trading. Some of the terms are linked to more information about that term. Also, some of the definitions will include other options terms, so the definition itself may leave you looking up more terms. However, any term found in a definition will have its own definition, too. We’ve started by separating out, “The Greeks”. The Greeks are the Greek alphabet letters that represent the different components that make up an option’s value, according to the Black-Scholes options pricing model. We hope you’ll find this to be a useful options trading resource.

The “Greeks”

Delta – The ratio of the movement in the option price for every point move in the underlying. An option with a delta of 0.5 would move a half-point for every 1-point move in the underlying stock; an option with a delta of 1.00 would move 1 point for every 1-point move in the underlying stock.

Gamma – The change in delta relative to a change in the underlying market. Unlike delta, which is highest for deep ITM options, gamma is highest for ATM options and lowest for deep ITM and OTM options.

Rho – The change in option price relative to the change in the interest rate.

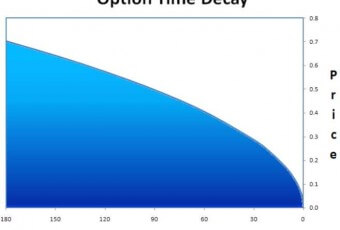

Theta – The rate at which an option loses value each day (the rate of time decay). Theta is relatively larger for OTM than ITM options, and increases as the option gets closer to its expiration date.

Vega – How much an option’s price changes per a one percent change in volatility.

Other Options Terms

American style – An option that can be exercised at any time until expiration.

Assign(ment) – When an option seller (or “writer”) is obligated to assume a long position (if he or she sold a put) or short position (if he or she sold a call) in the underlying stock or futures contract because an option buyer exercised the same option.

At the money (ATM) – An option whose strike price is identical (or very close) to the current underlying stock (or futures) price.

Backspreads – and ratio spreads are leveraged positions that involve buying and selling options in different proportions, usually in 1:2 or 2:3 ratios. Backspreads contain more long options than short ones, so the potential profits are unlimited and losses are capped. By contrast, ratio spreads have more short options than long ones and have the opposite risk profile. *Note: These labels are not set in stone. Some traders describe either position as option trades with long and short legs in different proportions.

Bear call spread – A vertical credit spread that consists of a short call and a higher-strike, further OTM long call in the same expiration month. The spread’s largest potential gain is the premium collected, and its maximum loss is limited to the point difference between the strikes minus that premium.

Bear put spread – A bear debit spread that contains puts with the same expiration date but different strike prices. You buy the higher-strike put, which costs more, and sell the cheaper, lower-strike put.

Binary Options – A binary option is a general term for an option that either pays a fixed percentage of the value amount you invested upon expiration, or nothing, depending upon whether or not the stated criteria was met. Since the payoff is either a fixed amount or nothing, binary options are sometimes referred to as fixed return options (FROs) or all-or-nothing options.

Bull call spread – A bull debit spread that contains calls with the same expiration date but different strike prices. You buy the lower-strike call, which has more value, and sell the less-expensive, higher-strike call.

Bull put spread (put credit spread) – A bull credit spread that contains puts with the same expiration date, but different strike prices. You sell an OTM put and buy a less expensive, lower-strike put.

Butterfly Spread – A Long butterfly is a three legged trade that consists of four total options and three strike prices. The first leg is a long call at the lowest strike price. The second leg is a long call at the highest strike price. The third leg is short two calls at a strike price midway between the first two legs.

Calendar Spread – A position with one short-term short option and one long same-strike option with more time until expiration. If the spread uses ATM options, it is market- neutral and tries to profit from time decay. However, OTM options can be used to profit from both a directional move and time decay.

Call Option – An option that gives the owner the right, but not the obligation, to buy a stock (or futures contract) at a fixed price.

Covered Call – Shorting an out-of-the-money call option against a long position in the underlying market. An example would be purchasing a stock for $50 and selling a call option with a strike price of $55. The goal is for the market to move sideways or slightly higher and for the call option to expire worthless, in which case you keep the premium.

Credit spread – A position that collects more premium from short options than you pay for long options. A credit spread using calls is bearish, while a credit spread using puts is bullish.

Debit spread – An options spread that costs money to enter, because the long side is more expensive that the short side. These spreads can be verticals, calendars, or diagonals.

Diagonal spread – A position consisting of options with different expiration dates and different strike prices — e.g., a December 50 call and a January 60 call.

European style – An option that can only be exercised at expiration, not before.

Exercise – To exchange an option for the underlying instrument.

Expiration – The last day on which an option can be exercised and exchanged for the underlying instrument (usually the last trading day or one day after).

Extrinsic value – The difference between an option’s intrinsic value and it’s current price (premium). For example, with the underlying instrument trading at 50, a 45- strike call option with a premium of 8.50 has 3.50 of extrinsic value.

Front month (or “nearest month”) – The contract month closest to expiration.

Implied Volatility – Implied volatility represents the expected volatility of a security over the life of an option.

In the money (ITM) – A call option with a strike price below the price of the underlying instrument, or a put option with a strike price above the underlying instrument’s price.

Intrinsic value – The difference between the strike price of an in-the money option and the underlying asset price. A call option with a strike price of 22 has 2 points of intrinsic value if the underlying market is trading at 24.

Naked option – A position that involves selling an unprotected call or put that has a large or unlimited amount of risk. If you sell a call, for example, you are obligated to sell the underlying instrument at the call’s strike price, which might be below the market’s value, triggering a loss. If you sell a put, for example, you are obligated to buy the underlying instrument at the put’s strike price, which may be well above the market, also causing a loss. Given its risk, selling naked options is only for advanced options traders, and newer traders aren’t usually allowed by their brokers to trade such strategies.

Naked (uncovered) puts – Selling put options to collect premium that contains risk. If the market drops below the short put’s strike price, the holder may exercise it, requiring you to buy stock at the strike price (i.e., above the market). Near the money: An option whose strike price is close to the underlying market’s price.

Open interest – The number of options that have not been exercised in a specific contract that has not yet expired.

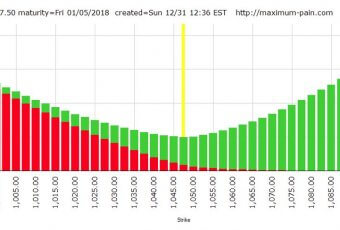

Option Pain – The strike price of the contracts with the most open interest for a given security.

Out of the money (OTM) – A call option with a strike price above the price of the underlying instrument, or a put option with a strike price below the underlying instrument’s price.

Parity – An option trading at its intrinsic value.

Premium – The price of an option. Put option: An option that gives the owner the right, but not the obligation, to sell a stock (or futures contract) at a fixed price.

Put ratio backspread – A bearish ratio spread that contains more long puts than short ones. The short strikes are closer to the money and the long strikes are further from the money. For example, if a stock trades at $50, you could sell one $45 put and buy two $40 puts in the same expiration month. If the stock drops, the short $45 put might move into the money, but the long lower-strike puts will hedge some (or all) of those losses. If the stock drops well below $40, potential gains are unlimited until it reaches zero.

Put spreads – Vertical spreads with puts sharing the same expiration date but different strike prices. A bull put spread contains short, higher-strike puts and long, lower-strike puts. A bear put spread is structured differently: Its long puts have higher strikes than the short puts.

Skew (or Volatility Skew) – Skew is simply the volatility curve that is formed by plotting the individual volatility levels of each option strike. The shape of this curve is often referred to as the volatility “smile” or “smirk.”

Straddle – A non-directional option spread that typically consists of an at the- money call and at-the-money put with the same expiration. For example, with the underlying instrument trading at 25, a standard long straddle would consist of buying a 25 call and a 25 put. Long straddles are designed to profit from an increase in volatility; short straddles are intended to capitalize on declining volatility. The strangle is a related strategy.

Strangle – A non-directional option spread that consists of an out-of-the-money call and out-of-the-money put with the same expiration. For example, with the underlying instrument trading at 25, a long strangle could consist of buying a 27.5 call and a 22.5 put. Long strangles are designed to profit from an increase in volatility; short strangles are intended to capitalize on declining volatility. The straddle is a related strategy.

Strike (“exercise”) price – The price at which an underlying instrument is exchanged upon exercise of an option.

Synthetic Short – An option trading strategy that is designed to mirror a short stock position. It’s created by selling an at-the-money call and buying an at-the-money put with the same expiration.

Time Decay – The tendency of time value to decrease at an accelerated rate as an option approaches expiration.

Time spread – Any type of spread that contains short near-term options and long options that expire later. Both options can share a strike price (calendar spread) or have different strikes (diagonal spread).

Time value (premium) – The amount of an option’s value that is a function of the time remaining until expiration. As expiration approaches, time value decreases at an accelerated rate, a phenomenon known as “time decay.”

Vertical spread – A position consisting of options with the same expiration date but different strike prices (e.g., a September 40 call option and a September 50 call option).

Volatility – The level of price movement in a market. Historical (“statistical”) volatility measures the price fluctuations (usually calculated as the standard deviation of closing prices) over a certain time period — e.g., the past 20 days. Implied volatility is the current market estimate of future volatility as reflected in the level of option premiums. The higher the implied volatility, the higher the option premium.